APPRAISAL — If you and we fail to agree on the amount of loss, either one can demand that the amount of the loss be set by appraisal … The appraisers shall then set the amount of the loss … They shall submit their differences to the umpire … Written agreement signed by any two of these three shall set the amount of the loss.

It is the job of an appraiser to assess and evaluate the damage and provide an impartial, informed estimate of the value of the loss. The policyholder and the insurance company both will have their own independent appraiser assess the damage, and if the two appraisers cannot agree then a third appraiser will be used to resolve the differences. The third appraiser is called an umpire and is either agreed between the appraisers or appointed by a court having jurisdiction. Appraisal boils down to an agreement of two of the three appraisers.

Understanding the Appraisal Process

Typically, insurance companies include an appraisal or arbitration clause in every policy. The clause stipulates that in the event that the property owner and the insurance company cannot agree on the value of the loss, either party may demand an appraisal and, in some occasions, that both parties must agree to enter into an appraisal.

Each party selects an appraiser and the two appraisers — one from the policyholder and one from the insurance company — work together to agree on the value of the damaged property. A mutually agreed-upon or court-appointed umpire will handle any disputes between the appraisers, and any agreement signed by two of the three parties will set the value of the loss. Arbitration is similar except that instead there is a panel of arbitrators that form the position of the umpire in appraisals and the lawyers or advocates for the parties present to the sometimes one person sometimes three panel of arbitrators.

The Insurance Appraisal Process Explained

John Minor, CGC, CFM, explains how the appraisal process can quickly resolve disputed claims between property owners and insurance companies.

Selecting an Appraiser

Appraisal has been successfully and quietly resolving disputed losses for 150 years. In some states appraisers are licensed but are not in most. After Hurricane Katrina, the State of Louisiana began licensing appraisers and conducting a background check and qualifications audit. We maintain certifications and licenses in all applicable states.

Louisiana Department of Insurance

Search for an Appraiser in the Louisianna Department of Insurance database

Louisiana Department of InsuranceWindstorm Insurance Network

The Windstorm Insurance Network

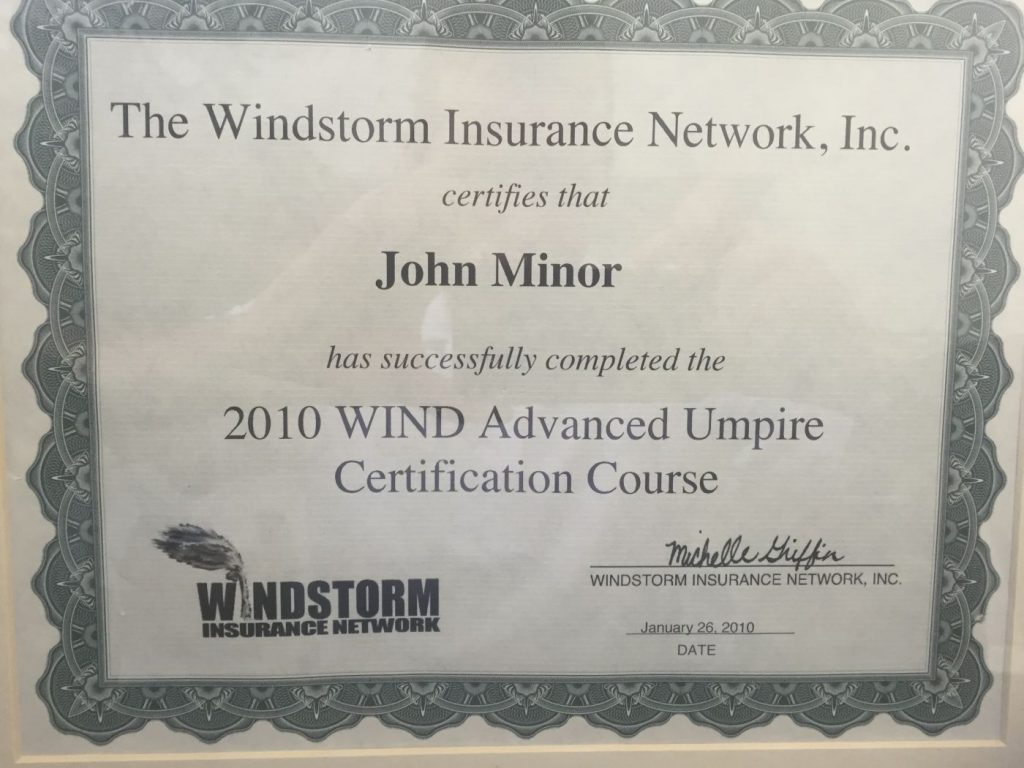

The Windstorm Insurance Network is a resource to find trained and certified appraisers. Wind is the largest group of its type and has taken the lead on the training of insurance appraisers and umpires.

Locate a WIND Certified Appraiser/Umpire in the Windstorm Insurance Network database

Ask for references from other professionals, insurance agents, Google and you’re likely to hear the same names over and over again. Typically, appraisers are paid by the hour but some policies in Florida used to allow a percentage agreement. The umpire is paid half by the insured and half by the company. A signed appraisal award followed by payment of the award is expected to close the claim all things being equal.

The Mediation Process and How It Works

Mediation is a less formal way than the courts to resolve claims between policyholders and an insurance company. A completely neutral and unbiased third party Department of Financial Services attorney assists in resolution of the dispute but does not dictate the outcome. During this mediation process, both parties collaborate to come to an agreement on the challenges associated with the loss.

Usually, this takes place in a mediation conference type facility that lends itself to the process. In the State of Florida, the office of Jimmy Patronis (Florida’s Chief Financial Officer) manages these programs. Their website is an excellent resource for more information on Mediation and Neutral Evaluation. They have a specific section on residential property mediation here:

Florida Department of Financial Services

Read more about Mediation and Neutral Evaluation in the Florida Department of Financial Services website.

Other downloads and resources on the Division of Consumer Services page include:

- Residential Property Mediation Program (PDF)

- Insurance Mediation Disposition Form, DFS-I4-2169 (PDF)

- Form to Request Personal Residential Insurance Mediation, DFS-I0-2082 (PDF)

- Initiate Mediation Request Online

Having worked as an insurance appraiser for most of my 25 years in the business, I have seen many ways to ruin an appraisal and even seen them sabotaged by the appraisers or parties for either side. These are the assignments to not take. When the parties and their lawyers or public adjusters are working as advocates in relation to their clients that is their role — but not necessarily the role of an appraiser. Knowing and working to this distinction is the art of the job.

Licensing is required in some states including Louisiana. The La. Dept of Insurance has created a licensed insurance appraiser designation that requires submission of qualifications and a background check. Please see my license as an example of same: John Minor’s Louisiana Department of Insurance Registered Appraisers Designation.

Hiring an experienced appraiser can keep the process moving along smoothly so you can get back to your life as quickly as possible or you can get a claim that was not getting done completed. The process begins when you first hire an appraiser, which is best done as soon as possible after the parties have reached an impasse. At this point, you must submit a letter to the opposing party to notify them of your intent to appraise the “value of the loss” so that they, too, can hire an appraiser within time periods delineated in the policy. Both appraisers will appraise the loss.

Insurance Claims Umpire

In the process of appraising the value of loss for damaged property, having a thorough and fair appraisal report from each party is usually enough to come to an agreement. Both parties sign off, the insurance company cuts a check, and work can begin on restoring the property.

However, occasionally the reports from the homeowner and the insurance company’s appraisers can have one or more major discrepancies. If an impasse is reached, many policies and state regulations allow for a third-party, independent umpire appraiser to be brought in to make an objective judgment.

The Alternative Dispute Resolution Process

Rather than engaging in prolonged and expensive litigation, this alternative dispute resolution process can save both parties significant money and time. Complete has a long-standing record serving as the appraiser for homeowners and insurance companies, as well as the umpire in disputes between the parties.

Whether the damage is due to fire, flood, wind storm, hail or other natural phenomena, Complete has the experience working on residential, commercial, and industrial properties from every angle to know how to resolve discrepancies and disagreements. We are intimately familiar with the actual time and realistic costs of materials it takes to bring a property back to its original state.

Save Time and Money with an Appraisal

If a home or business has suffered damage, getting an appraisal early in the process can save both insurance companies and owners time and money, ensuring that all of the unique circumstances of the claim have been considered.

While policies vary by state and company, the following language from the National Flood Insurance Program Dwelling Form on FEMA.gov is a good example of how appraisals and assignment of an umpire are typically handled:

If you and we fail to agree on the actual cash value or, if applicable, the replacement cost of your damaged property to settle upon the amount of loss, then either may demand an appraisal of the loss. In this event, you and we will each choose a competent and impartial appraiser within 20 days after receiving a written request from the other. The two appraisers will choose an umpire. If they cannot agree upon an umpire within 15 days, you or we may request that the choice be made by a judge of a court of record in the State where the covered property is located.

The appraisers will separately state the actual cash value, the replacement cost, and the amount of loss to each item. If the appraisers submit a written report of an agreement to us, the amount agreed upon will be the amount of loss. If they fail to agree, they will submit their differences to the umpire. A decision agreed to by any two will set the amount of actual cash value and loss, or if it applies, the replacement cost and loss.

Each party will pay its own appraiser and bear the other expenses of the appraisal and umpire equally.

Should you need the services of an experienced, impartial appraiser or umpire, call the professionals at Complete. We are experts in appraisal and mediation support and arbitration — we’ve been in business since 1997, and have gotten the best possible results for hundreds of clients.

Team Complete: Experienced Property Damage Appraisers

On some occasions, the work of inspection is done jointly and on other occasions it is not. During this assessment and research phase, the appraisers will put their years of experience into providing an accurate report. These appraisals may have expert reports within them in regards to weather, engineering, air quality, business interruption, or any other segment of the claim. We feel our group excels in this portion of the job out of a willingness to be knowledge dominant on our files and the experience to know what happens next.

We have experience in the realities of the time and cost of materials needed to correct the damage and applicable building codes and regulations that govern same. All of this information will be factored into the replacement cost value detailed in the final report. Having an accurate, comprehensive appraisal report is your best asset when coming to a fair number for the value of a disputed loss.

If you are in need of appraisal services, call John Minor or one of our others appraisers at Complete today to ensure you get a respected and known appraiser that will provide you an honest day’s work and come back with a good number.

Complete, Inc. offers insurance claims appraisal service Nationwide, with a focus on Gulf Coast states of Florida, Texas, Louisiana, Mississippi, and Alabama.