Flood insurance has been a staple of development since 1968 when it was created by the Federal Government. The policy is underwritten by the American people and managed by FEMA now a part of The Department of Homeland Security. There are more than 20,200 communities, and as of June 30, 2011, the program had nearly 5.6 million policies in force with a total insured value of $1.246 trillion.

While obviously many of those are on the coasts there are also many lake and riverine properties that would not have been developed had it not been for the security that the National Flood Insurance (NFIP) program brings. The major glitch has been that the program is not and has not been actuarially sound, it is hemorrhaging money and requiring bailouts from the Federal Reserve. This has led to last-minute deals in congress to keep the program authorized and funded, usually year-to-year. This perennial revisiting of the problems posed by the deficit that NFIP runs is scheduled to change with the implementation of the Biggert Waters flood insurance reform act of 2012.

- Flood Insurance — including claims handling will increase in rates for non-compliant structures where average rates were less than $2000 per year now climbing to $12,000, even $30,000 per year depending on elevation and location.

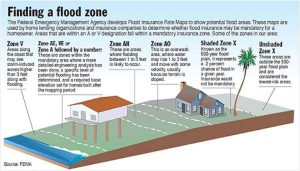

- Flood Hazard Mapping — use of DFIRMS and remapping careful study of the construction of levees and dams.

- Grants — mostly hazard mitigation grants.

- Management of Floodplains — including stricter compliance with the 50% rule and other components of the Code of Federal Regulations 44 (CFR 44).

What is surprising about the program is that, in general, it will run and makes sense except where it does not. The program has never been set up to earn a pillow or reserve like other insurers are required to do. This is fine in a year with light flooding but in years following a Katrina in 2005 or almost as bad Sandy in 2012 it is catastrophic. Most of the policies in the country are properly priced and work as they should. In fact, more than 80 percent of policyholders (representing approximately 4.48 million of the 5.6 million policies in force) do not pay subsidized rates.

About 20 percent of all NFIP policies pay subsidized rates. Only a portion of those policies that are currently paying subsidized premiums will see larger premium increases of 25% annually starting this year, until their premiums are full-risk premiums. Those that will see the biggest effects the quickest are following

Five percent of policyholders — will see immediate changes for subsidized policies including:

- Non-primary residences — This is in my experience the concrete block slab on grade houses we see on almost every older beach community that floods every storm and has to be gutted and NFIP pays to replace the contents and finishes

- Businesses

- Severe repetitive loss properties — those that over a short number of years have claims that collectively exceed the appraised value of the property

Subsidies will no longer be offered for policies covering:

- Newly purchased properties — this will greatly affect the marketability of pre-firm or those properties not paying fair rates per the loss potential.

- Lapsed policies — this is extremely important as many people do not seem to feel the need for flood insurance and will purchase the policy following a storm and then eventually not renew

- New policies — covering properties for the first time

The 80% of all NFIP policies that already pay full-risk premiums will not see these large premium increases. Most policyholders will see a new charge on their premiums to cover the Reserve Fund assessment that is mandated by BW-12. Initially, there will be a 5% assessment to all policies except Preferred Risk Policies (PRPs). The Reserve Fund will increase over time and will also be assessed on PRPs at some undetermined future date.

There will be a lifeline to some of these properties including grants they include:

Mitigation Grant Program (HMGP) — The Hazard Mitigation Grant Program provides grants to implement long-term hazard mitigation measures after a major disaster declaration. The purpose of HMGP is to reduce the loss of life and property due to natural disasters and to enable mitigation measures to be implemented during recovery from a disaster.

Flood Mitigation Assistance (FMA) — The Flood Mitigation Assistance program provides funds on an annual basis so that measures can be taken to reduce or eliminate risk of flood damage to buildings insured under the NFIP.

Pre-Disaster Mitigation Program (PDM) — The Pre-Disaster Mitigation Program provides nationally competitive grants for hazard mitigation plans and projects before a disaster event. States can receive PDM funds regardless of whether or not there has been a disaster declared in that state.

Information about the HMA programs can be found at http://www.fema.gov/hazard- mitigation-assistance

I can share with you in my experience in Hurricane Sandy that we are already seeing changes in the claims handling side of the NFIP. In the past the policy was relatively straight forward and I believe fair. It is increasingly becoming more strict and stringent and certainly does not qualify as a policy that would “make one whole.“

I understand the need to reel in the costs but it is my humble opinion that the policy should cover that which is right by the building and not rely on technicalities to reduce or eliminate coverage, however, it beats the heck out of the alternative — self-insurance.