Flood damage claims are a difficult process. The successful resolution of a flood loss requires many steps and good decisions at critical times during the financial and physical recovery. In the vast majority of instances FEMA, the National Flood Insurance Program (NFIP) and other involved agencies do an adequate job in a hard process.

The subject of this post is the NFIP standard policy covers what it does and not what it doesn’t with very little wiggle room. It makes the correct path to follow to achieve a successful conclusion pretty simple, right? There are decisions that are the drivers in the outcome on these losses in general.

Policy – The first is a policy that meets your needs. My only advice would be to insure to value and if your home valuation exceeds $250,000 single-family residential then please consider excess flood. This will insure the residence in excess of the $250k up to replacement value or a number you select. There are also private flood providers out there to consider that are relatively new to the market. Other than a few selections the policy is what it is without much in the way of endorsements or other opportunity to avoid additional risk. Find a good agent and pay the premiums and remember a 30 day waiting period.

After the Loss

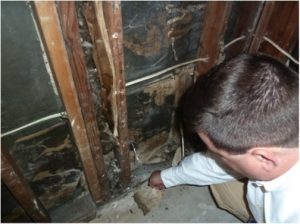

Mitigation – Obviously safety is Job 1 and being aware of your surroundings is keen among same. Steering clear of downed power lines, care around gas lines that may have been ruptured and in my experiences from the field, be aware of lots of snakes hunting a new home. Following the water finally coming down or returning after evacuation orders, one is faced with a great big mess. Now is the time to document, document, document, via photos, from above finished floor elevation (FFE) and also from grade, making sure to show any appliances that may have been submerged.

Trust me… I know and have been there in my home. The decision to make here: is the property salvageable, can it be fixed, or even should it? It is impossible for me to articulate all of the conditions that make for the right answer but what I can share is what you might consider.

The first is to ascertain if the structure is sound and safe to enter. If it is not terribly damaged you likely want to consider bringing in a team to clean, dry and prepare the building for repair. I know friends and family will want to help but their efforts might be better used elsewhere on this insured event. The early mitigation by a pro is almost always the right decision save the rare exception.

These exceptions include the obvious which is… do not hire a crook! There are state and federal agencies that can give one guidance on how to not hire a crook and I recommend you vet a restoration contractor vigorously and if they pass muster then let them do their job. In my firm when we are working as restoration contractors we sign a work authorization that allows us to do the job for the dollars agreed between the adjuster and my office.

Mark Twain said “If you want to know if you can trust someone… trust someone.” The only times I would hedge my bet in these circumstances would be in the event of a residence in the SFHA (Special Flood Hazard Area). These properties take special handling and may appear as a candidate for restoration but in reality are not eligible for a building permit. Residences in the SFHA damaged in excess of 50% of their appraised value that are located below the BFE (Base Flood Elevation) must be elevated in compliance or razed and new construction permitted.

This is the only time (save a crook discussed before) where spending big dollars on drying and selective demolition is not a good bet and will actually be reduced from the limits of the policy. So if all the new homes being built in your neighborhood are going on pilings and you flood, get to know your local floodplain manager.

The Claim Process

The vast majority of claims resolve readily and move forward in strict compliance with policy and proof of loss requirements. However the ones that do not require some hard decisions on where to take a disputed value. The first step, obviously, is to attempt to work things out with the insurance co. adjuster that is trained on the policy and should be working to get you everything that they can under the policy.

There is value in having persons knowledgeable that work for the policyholder attempting to understand the damages to the building and convey that to the property owner in the form of estimates, engineering reports, contents inventories and building diagnostics. This team is typically either hired by the hour to provide their professional opinions or are the repair provider and their time spent documenting the damages are built into their repair costs. This is probably the path of least resistance and when done right can really work out great for all parties.

FEMA assist – In the policy there are resources to request a review of a dispute. This includes writing a letter to the program with your request and reasons for same. I have seen these work but it appears that sometimes personnel may be stretched a little thin to provide this service successfully. If you need help filing a complaint or need to contact someone from FEMA who can help you in this regard, click here for a useful contact list.

Public Adjuster – Professional licensed adjusters that charge a fee to negotiate the claim on behalf of the owner. The percentage may be anywhere from 5 – 10% of the loss payment. These licensed adjusters will attempt to maximize the payment in exchange for a fee. One may or may not get much hard restoration or repair advice, but the numbers typically are higher than what a company adjuster might have thought of on their own. This is a tough business.

Appraisal – This is an alternative dispute process included in the policy. The insurance company and the owner must agree to the scope of the damages in order for appraisal to be rightfully invoked. The two appraisers set the value of the loss and the umpires works on the differences. Any agreement of two of the three is binding.

Litigation – The ability to litigate against the NFIP exists, however it just is a hard way to settle a loss. The government is immune from civil penalty and as such attorney fees are not eligible to be recouped by property owner litigants. In addition to the cost of the attorneys there will be expert witnesses to hire to establish the values of the issues between the parties.

This is sample of the questions and answers that follow a flood loss. I have generated this knowledge after 22 years in the industry. I have served as the restoration contractor on flood-damaged properties as well as working both sides of flood claims as an appraiser or expert in addition to the working in the middle as an umpire. The following is a case I was involved with after Ike. If you have questions in regards to your flood loss – multifamily, commercial, or residential – send me an email as I may have an answer or a recommendation on where to look for one.

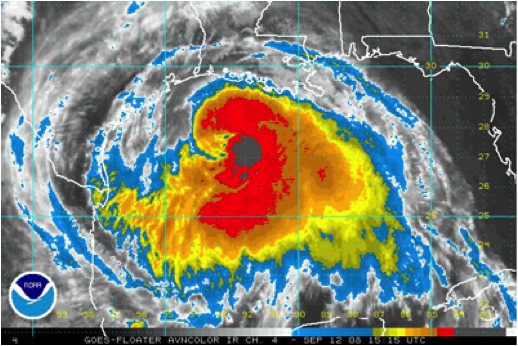

The Point – Houston, Texas

Following the destruction of Hurricane Ike on September 13, 2008, Mr. John Minor, of Complete General Contractors, Inc., was retained as an appraiser by the ownership and counsel of a large apartment complex located in Pasadena, Texas– a suburb of Houston, which lies just off Galveston Bay and the shipping channel. The entire expanse of this 700,000 square foot property was flooded as a result of Hurricane Ike, which made landfall on September 13th, 2008 as a strong Category 2 storm. This property consisted of approximately 570 units. All of the first-floor units, of which there were 270, flooded.

Debate and lengthy litigation ensued between the parties over whether or not appraisal was an appropriate means to settle this loss and whether or not it was fitting for appraisers to determine the extent of damage to a particular item if that item was already included in the scope. It had been widely accepted that the scope is set early-on in the flood appraisal process. This file instructed the appraisers to consider the damage to an item, as well as the cost of repair to that item.

After a year of negotiating, and just prior to the commencement of trial, an agreement was reached by the parties to enter into appraisal under the NFIP program. With two seasoned appraisers and one quality umpire, an agreement was reached in reached excess of 7.5 million dollars with all three parties signing off on the appraisal agreement.

“The actual language of the SFIP provides as follows: “If you and we fail to agree on the actual cash value or, if applicable replacement cost value of your damaged property to settle upon the amount of loss, then either may demand an appraisal of the loss.”

Complete General Contractors, Inc. specializes in hurricane damage restoration from residential, commercial, industrial and by municipality. John Minor has worked post-hurricane sites since Opal in 1995; his experience is far reaching – from the Carolina’s to Texas and all along the coast of Florida.

The staff of Complete can meet with you to review your preparedness plan, and we will be there afterwards should you ever need us. We specialize in the actual restoration, prevention, as well as, dispute resolution of a claim. Call the company the pros choose – call Complete.

This information should not be substituted for professional legal advice; consult with your lawyer for legal advice and ask your insurance professional to discuss the details of your policy and insurance needs.