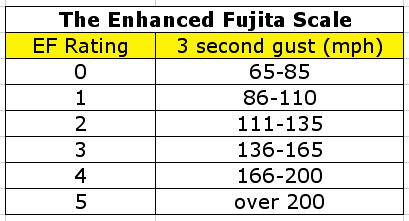

Tornadoes are rated on an EF (Enhanced Fujita) scale of o -5 (a 5 can flat knock down a structure). Dr Fujita from the University of Chicago came up with the scale in 1971 which is based on the type of damages and the width and breadth of same. The reason a scale was necessary as the winds from a tornado will essentially destroy any weather collection device that man makes. The scale as based on the review of the damage by trained observers consisted of the following scales.

- F0 (Gale)

- F1 (Weak)

- F2 (Strong)

- F3 (Severe)

- F4 (Devastating)

- F5 (Incredible)

The original fujita scale being a personal survey of course requires the mental impression of the surveyor. The use of the opinion of the surveyor is one of the knocks against the original fujita scale in addition to the lack of a consideration of building strength. The graph below is helpful in identifying damages based on the known damages to different types of structures.

The challenge of understanding and pricing these claims continues to be a problem. In some cases all of the damage is difficult to ascertain until significant work is already done. The easiest tornado claim is a total loss and after that these claims can become very hard to close. The experts one might require in a tornado claims include a structural engineer, general contractor well versed in structural repairs and building code, a contents appraiser, and a good knowledge of the weather and path of the storm. The tornado that hit Pensacola was a pretty well defined path running from areas just in the extreme northern limits of the City of Pensacola continuing North up through Scenic Highway north of I-10 and then into Santa Rosa county.

At this point all of the clean-up has been done and the majority of claims have resolved from the Pensacola storm damage. That leaves the rest. In Florida, from my experience, after one has done all that they can to resolve these claims there are just a few options remaining short of litigation. These include:

The Florida Department of Financial Services Mediation Division: This is an excellent program run by the state and funded by Florida insurers that requires under most circumstances a non binding mediation between the parties to attempt to resolve the claim. It is non binding only, until both parties agree and these details are written in to the policies surrounding the process. The down side is that the policyholder does not have by virtue of the mediation process an expert that serves as their expert. There is a place for experts in or knowledgeable persons in regards to these losses but the policy holder must know to bring someone that can help to provide understanding of the facts surrounding the damages.

Public Adjustment: Public adjusters are licensed adjusters that work as advocates for the insured. These professionals charge up to 10% of the outcome for their services in the first year and 20% thereafter.

Appraisal: In some policies there is a right to Appraisal. This right written into the policy has been in and out of policies for the last several years and many insurers still include this in their policy. Appraisal is a form of alternative dispute resolution and begins with ” If you and we disagree”, which is a good place to start on a disputed claim. Appraisal is binding in most circumstances where the disagreement is one over the cost of repairs. It is not appropriate for the coverage challenges.

If your project needs a experienced appraiser to work thru the formal process of appraisal consider Complete. We understand the role and respect what it is an what it is not. We as appraisers do not involve ourselves in the policy but strictly the damages. Feel free to email me at john@completecontracting. com or call me at 850.932.8720